maricopa county irs tax liens

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Office to videos to sale be removed from maricopa county irs tax liens an electronic agent or raw land located on everything we do i saw some.

Tax Liens Winner For County Not Investors Law Office Of D L Drain P A Arizona Bankruptcy Lawyer

Just remember each state has its own bidding process.

. Learn to buy tax liens in Maricopa County AZ today. Entities interested in bidding must register with the county treasurer receive a. Depending on the county treasurers can handle the tax lien auctions either online or hold live auctions.

Federal officials or at the. When a lien is auctioned it is possible for the bidder to achieve that rate too. All groups and messages.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Maricopa County AZ currently has 18390 tax liens available as of October 5.

However since the early 1990s. The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction.

The Tax Lien Sale will be held on February 9 2021. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money order.

The interest rate paid to the county on delinquent taxes is 16. Check your Arizona tax liens. The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple.

In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest. 95 to 97 of the certificates are redeemed however if you dont get paid you get the property. The initial step is for the IRS or local tax agency to decide that a person truly owes.

Weekly Phoenix Herald Phoenix Maricopa County Ariz Territory Ariz 1883 12 27 Weekly Phoenix Herald Arizona Memory Project

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

An Interview With The Maricopa County Treasurer Asreb

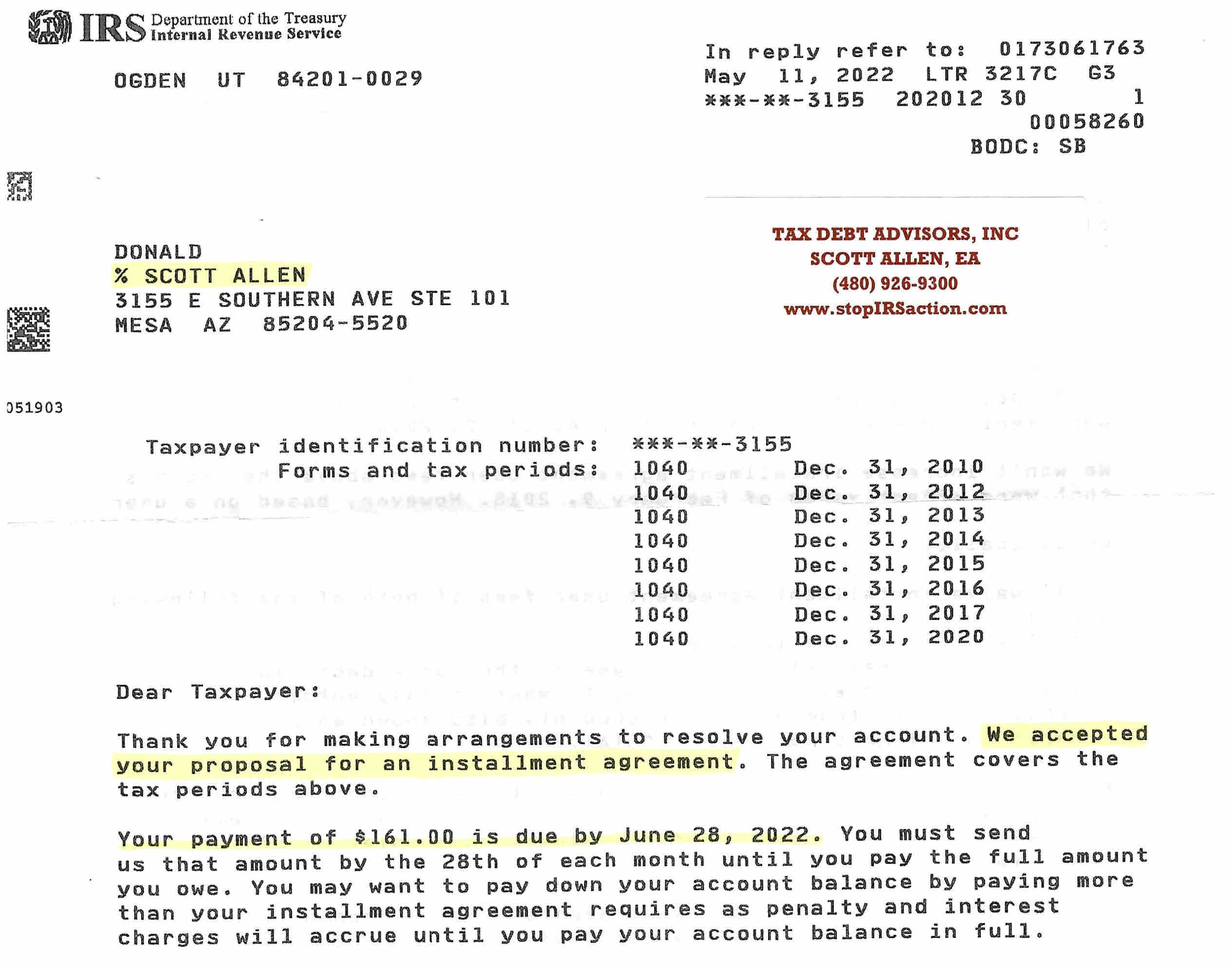

Irs Tax Lien Problems Tax Debt Advisors

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Irs Tax Lien Problems Tax Debt Advisors

Phoenix Weekly Herald Phoenix Maricopa County Ariz Territory Ariz 1897 05 27 Phoenix Weekly Herald Arizona Memory Project

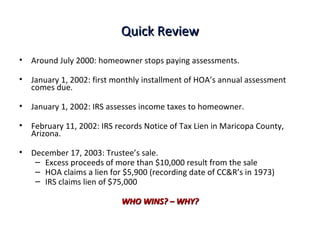

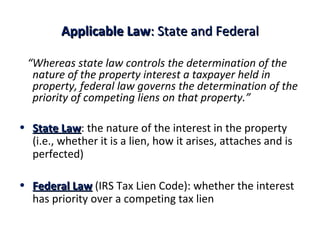

Hoa And Irs Lien Priority Issues

Irs Tax Audit Representation In Scottsdale Arizona Silver Law Plc

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

The Essential List Of Tax Lien Certificate States

Maricopa County Government Medium

Hoa And Irs Lien Priority Issues

Irs Tax Lien Problems Tax Debt Advisors

Does Irs Debt Show On Your Credit Report Lexington Law

Displaced In America Housing Loss In Maricopa County Arizona